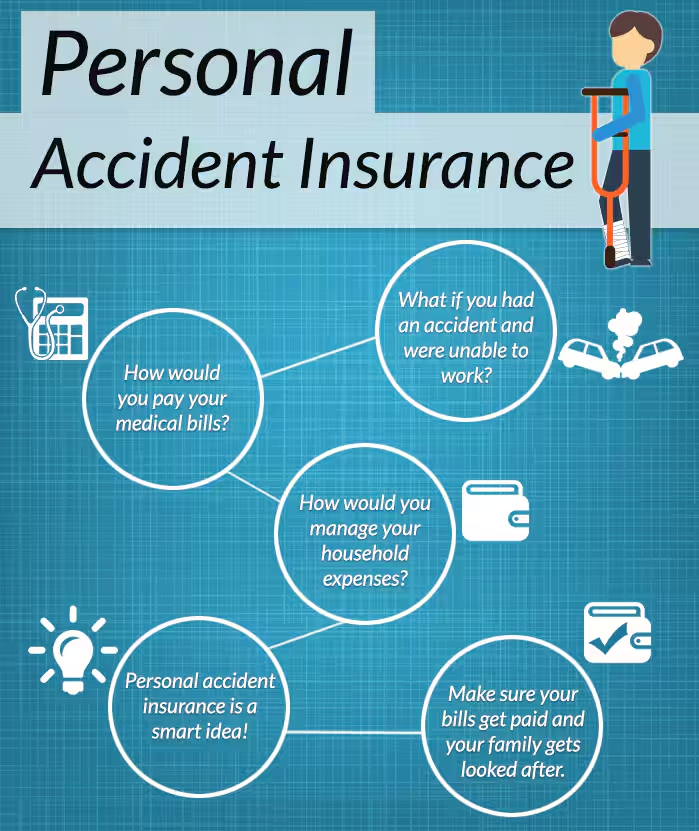

In life, accidents can happen unexpectedly and instantly turn our world upside down. The consequences can be physically and financially devastating, whether it’s a slip and fall, a car collision, or a workplace mishap. That’s where personal accident insurance steps in as a vital shield against the uncertainties of life.

Let’s delve into what personal accident insurance entails, why it’s crucial to have, and how it complements your overall financial security.

What is Personal Accident Insurance?

Personal accident insurance, also known as accidental death and dismemberment insurance (AD&D), is a type of insurance policy that provides financial protection in the event of accidental injuries, disabilities, or death. Unlike medical insurance, which covers medical expenses from illnesses and injuries, accident insurance focuses specifically on accidents and their consequences.

This insurance typically offers coverage for various situations, including bodily injuries resulting from accidents, permanent disabilities, and accidental death. The policy may also include benefits such as ambulance services, hospitalisation expenses, and rehabilitation costs, depending on the terms and conditions outlined in the policy.

Reasons to Buy Personal Accident Insurance

There are several reasons for buying accident insurance. Some of them are mentioned below.

- Comprehensive Protection: While health insurance best is essential for covering medical expenses, accident insurance offers an additional layer of protection specifically tailored to accidents. It ensures that you and your loved ones are financially secure in the event of unforeseen accidents, whether at home, work, or while travelling.

- Supplementing Medical Insurance: Even with the best health insurance policy, there may be gaps in coverage, especially regarding accidents. Accident insurance bridges these gaps by providing additional financial support for expenses not covered by medical insurance, such as transportation costs, home modifications, or loss of income due to disability.

- Financial Stability: Accidents can result in temporary or permanent disabilities that may prevent you from working and earning an income. Accident insurance provides compensation in the form of a lump sum or periodic payments to help you and your family cope with financial obligations during such challenging times.

- Affordability: Accident insurance is often more affordable than comprehensive medical insurance policies. Its cost-effectiveness makes it accessible to individuals and families looking to enhance their financial security without breaking the bank. With various coverage options available, you can choose a policy that aligns with your budget and coverage needs.

- Peace of Mind: Knowing that you’re protected against the financial ramifications of accidents can bring peace of mind to you and your loved ones. Accident insurance offers reassurance that, in the event of an accident, you’ll have the necessary financial resources to focus on recovery without worrying about the associated expenses.

Choosing the Best Personal Accident Insurance Policy

When selecting a personal accident insurance policy, it’s essential to consider several factors to ensure you’re getting the best coverage for your needs:

- Coverage Limits: Evaluate the coverage limits offered by different policies to ensure they align with your financial requirements in the event of an accident. Opt for a policy with adequate coverage for medical expenses, disability benefits, and accidental death benefits.

- Exclusions: Pay attention to the exclusions specified in the policy, as certain activities or pre-existing conditions may not be covered. Understand the policy’s limitations to avoid any surprises when filing a claim.

- Premiums and Deductibles: Compare the premiums and deductibles of various insurance policies to find the best value for money. When deciding, consider factors such as affordability, coverage breadth, and deductible amounts.

- Claim Process: Assess the ease and efficiency of the claim process offered by different insurance companies. Look for insurers with a reputation for prompt claim settlement and excellent customer service to ensure a hassle-free experience during claim submission.

- Additional Benefits: Some accident insurance policies may offer additional benefits, such as coverage for accidental medical expenses, emergency evacuation, or worldwide coverage. Evaluate these additional benefits to determine their relevance and value to your specific needs.

Bottom Line

By supplementing your medical insurance coverage with an accident insurance policy, you can ensure comprehensive protection against the uncertainties of life. When choosing an accident insurance policy, consider coverage limits, exclusions, premiums, and claim processes to select the best option for your needs. With the right policy in place, you can face life’s uncertainties confidently, knowing you’re prepared for whatever comes your way.

Explore your options, compare policies, and choose the best health insurance company to safeguard your financial future. Don’t wait until it’s too late—take the first step towards securing your financial future today. Visit the Niva Bupa website or contact their dedicated team to learn more about how their personal accident insurance plans can provide you with the peace of mind you deserve.